Sales Tax Measure D-20 Information

In November 2020, voters passed Measure D-20 to generate revenue to fund many of the community’s and Council’s key priorities. Measure D-20 revenue is expected to total just under $12 million for the first three fiscal years (April 1,2021 through June 30,2023.) The list below outlines the action items that are possible to fund due to the revenues from the new Measure. Each funded item on the list is linked to one or more of the 2021-2023 Strategic Priorities for the expenditure of Measure D-20 funds. Of the $12 million in projected Measure D-20 revenue, about $9.5 million will be used for Public Safety, $1 million will be used for infrastructure investments, and $1.5 million will go toward other priorities, including staff retention and attraction.

A detail of each line item in the chart below can be viewed by clicking on the item description.

Sales Tax Measure D-20 Budgeted Expenditures

More Information

Study Sessions, Videos & Related Meetings Information

In November 2020, voters passed Measure D-20 to generate revenue to fund many of the community’s and Council’s key priorities. How to spend Measure D-20 funds was discussed in Study Sessions and during City Council and Finance Committee meetings. Information & videos from these study sessions and meetings can be found below.

D-20 STUDY SESSION INFORMATION

Please click the links below for information from the Measure D-20 study sessions which were provided as a platform for residents to participate in community oversight regarding how Measure D-20 funds should be spent.

Finance Committee Meetings Including D-20 Fund Discussion

Between April 22, 2021 and May 27 2021, the Finance Committee held a series of virtual meetings to review various sections of the budget including General Funds and Measure D-20 funds. These meetings were open to the public and recordings of the meetings can be viewed on the City of Atascadero YouTube channel by clicking here.

City Council Meetings & Related Information

Information and detail of the City Council meetings related to the 2020 Sales Tax Measure #D-20, including archived Council meeting videos, staff reports, PowerPoint presentations, Resolutions and other related documents, can be accessed via the following links:

May 26, 2020 Council Meeting

July 14, 2020 Council Meeting

August 11, 2020 Council Meeting

September 22, 2020 Council Meeting

Resolutions and Ordinances

Measure D-20 Q & A Information

Please note: The City is legally prohibited from promoting or opposing candidates, political committees or ballot measures. The answers to the questions posted below are factual statements taken from published reports and/or from the ballot measure language and ordinance, and in no way either promote or oppose the ballot measure up for voter consideration in November, 2020.

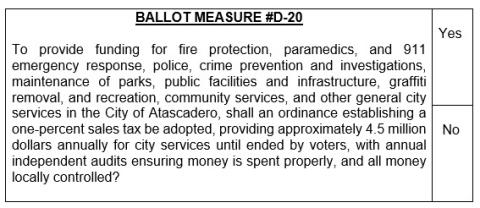

Q. What is the local sales tax measure on the ballot this year in Atascadero?

A. There is one General Sales Tax Measure on the ballot in Atascadero for the November 2020 election, which is Measure #D-20, for an “ESSENTIAL SERVICES TRANSACTIONS AND USE TAX". This is what you'll see on your November ballot:

Q. What is the difference between a General Sales Tax Measure and a Special Sales Tax Measure?

A. Special Sales Tax Measures require a 2/3 plus 1 majority vote in order to pass, and legally restricts the funds to a special purpose. General Sales Tax Measures require a 50% plus 1 majority vote to pass, and may be used for any legal purpose. Measure #D-20 is a General Sales Tax Measure.

Q. What is the current sales tax rate in Atascadero, and how much will it go up?

A. Since passage of Measure #D-20, the current local sales tax rate in Atascadero is 8.75%. Prior to the sales tax increase of one percent, the rate was 7.75%.

Q. When would the sales tax increase go into effect?

A. If passed by the voters in November 2020, the tax would become effective no sooner than April 1, 2021.

Q. How much additional revenue is expected from this sales tax increase?

A. Once put into effect; the proposed sales tax measure is estimated to generate $4.5 million in additional annual revenue to the City of Atascadero.

Q. What will revenue from the Sales Tax increase be spent on?

A. As stated in the description to be placed on the ballot, Measure #D-20 is intended to provide funding for fire protection, paramedics, 911 emergency response, police, crime prevention and investigations, maintenance of parks, public facilities and infrastructure, graffiti removal, recreation, community services and other general city services.

Q. If Measure #D-20 were to pass, will there be any oversight for the expenditure of Measure #D-20 funds?

A. At the July 14 and September 22 City Council Meetings, the City Council established a two phase approach to implement public engagement and accountability for the proposed Measure #D-20 funds should the measure be passed by voters on November 3. Phase 1 – Gather Input and Public Process – will expand the City’s current public engagement process to include more public outreach and input with an estimated 20 public meetings discussing the expenditure of D-20 funds between January and June 2021. Phase 2 – Accountability – will include the preparation of an annual report to be reviewed, along with the City’s annual audit, at a heavily publicized joint meeting of the Finance Committee and Citizens Sales Tax Oversight Committee (CSTOC). The annual report will include metrics and a narrative on what the funds were used for and what was accomplished with the funds. After review of the annual report and audit, the CSTOC will report their findings to the City Council.