2024 Atascadero Local Roads and Vital Services Funding Extension Measure

Ballot Measure Overview

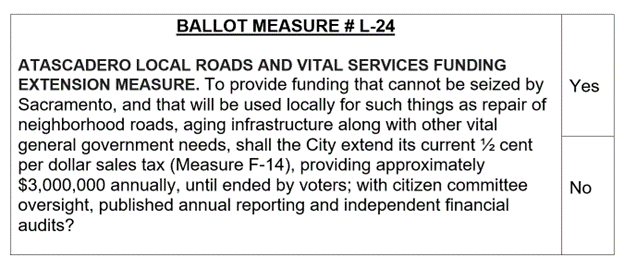

On the November 2024 ballot, the Atascadero Local Roads and Vital Services Funding Extension Measure (also known as Measure L-24) will ask voters to consider extending the current half-cent per dollar (0.5%) general sales tax approved by voters in 2014. That measure is commonly known as Measure F-14.

Measure L-24 would provide approximately $3 million of funding annually that will stay in Atascadero for the repair of neighborhood roads and aging infrastructure along with other vital City needs.

Current Oversight

A nine-member Citizens’ Oversight Committee meets annually to review the use of sales tax funds and ensure transparency for funds raised by Measure F-14. The Oversight Committee was formed in the wake of the adoption of Measure F-14. Similar to Measure F-14, the Atascadero Local Roads and Vital Services Funding Extension Measure will continue the citizen committee’s oversight of the funds raised by this measure.

Additionally, all funding activity would continue to be published in annual reporting and subject to independent financial audits, ensuring maximal use of the revenue.

Background

Over the past decade, funds from Measure F-14 (approximately 9% of the City’s annual budget) have significantly improved the quality of neighborhood roads in Atascadero. 100% of the funds provided by Measure F-14 have been spent on road improvements throughout the community as directed by the City Council. These expenditure choices were made consistent with an advisory vote that shared the ballot with F-14 where residents overwhelmingly expressed a preference for prioritizing road repairs.

Originally approved by voters in 2014, Measure F-14 became effective on April 1, 2015, and is set to expire on March 31, 2027, unless renewed by the voters sooner.

Since its implementation, Measure F-14 has funded 14 projects equivalent to nearly $20.4 million in neighborhood road repair. These projects have resurfaced over 55 miles of neighborhood roads, improving overall pavement condition and infrastructure stability.

Aided by the funds received from Measure F-14, as of June 11, 2024, the City’s overall pavement condition index (PCI) has increased by 9 points, from 47 to 56—a significant increase from the expected 17-point decrease if Measure F-14 had not passed.

Next Steps

Atascadero voters will vote on the Atascadero Local Roads and Vital Services Funding Extension Measure, appearing on the November 2024 General Election ballot as Measure L-24. Registered voters will be able to vote the upcoming November election on Tuesday, November 5, 2024, or sooner via vote-by-mail.

For more information about voting in Atascadero, please visit the Election and Voting Information webpage on the City’s website or contact the City Clerk’s Office at cityclerk@atascadero.org or (805) 470-3400.

Documents & Resources

FAQs

General Sales Tax Information

What is a general sales tax?

A general sales tax is a tax approved by local voters that is applied to the sale of goods and services to raise funds for that jurisdiction.

What is the current sales tax rate in Atascadero?

The current sales tax rate in Atascadero is 8.75%, and 0.5% is attributable to Measure F-14.

How is the sales tax collected?

In Atascadero, the sales tax is applied to the sale of goods and services that occur within the city.

How have Atascadero voters previously voted on measures about the general sales tax?

In November 2014, Atascadero voters originally approved Measure F-14, imposing a half-cent per dollar (0.5%) general sales tax increase on the sale of goods and services in Atascadero for twelve (12) years (April 1, 2015 to March 31, 2027). The vote was 58% Yes and 42% No.

City Finances

How much revenue will Measure L-24 generate?

As the potential extension of Measure F-14, Measure L-24 is expected to generate approximately $3 million per year.

How much revenue does Measure F-14 generate?

Measure F-14 generates approximately $3 million per year. This equates to approximately 5% of the City’s annual budget.

How does the City currently use the Measure F-14 revenue?

o This tax revenue is used for a variety of general city services, including public safety, addressing homelessness, investing in parks and recreation services, City programs, and more. However, Measure F-14 funds have historically been primarily used for the maintenance and repair of neighborhood roads.

o Since its implementation, Measure F-14 has funded 14 projects equivalent to nearly $20.4 million in neighborhood road repair. These projects have resurfaced or rehabilitated over 52 miles of neighborhood roads, including the removal and replacement of asphalt on full roadway sections where needed and improved drainage and roadside slope stability.

o Aided by the funds received from Measure F-14, the City’s overall pavement condition index (PCI) has increased by 9 points, from 47 to 56—a significant increase from the expected 17-point decrease if the measure had not passed.

Who oversees the usage of sales tax revenue?

A Citizens’ Oversight Committee meets annually to review the use of sales tax funds.

About Measure L-24

What is the Atascadero Local Roads and Vital Services Funding Extension Measure?

If approved, Measure L-24 would extend a half-cent per dollar (0.5%) general sales tax and could provide approximately $3 million annually, until ended by Atascadero voters. All revenue from the Atascadero Local Roads and Vital Services Funding Extension Measure would continue to stay in Atascadero.

Who will oversee the usage of Measure L-24 revenue?

A Citizen’s Oversight Committee meets annually to review the use of all sales tax funds. The Atascadero Local Roads and Vital Services Funding Extension Measure does not remove any accountability requirements and is subject to the Committee’s review.

Is Measure L-24 a special tax or a general tax?

Measure L-24 is a “general tax”, not a “special tax.” The revenues collected could be used on any general City services such as public safety, addressing homelessness, repairing streets and potholes, and other general City services.

Would the Atascadero Local Roads and Vital Services Funding Extension Measure increase the sales tax rate?

No. If passed, the Atascadero Local Roads and Vital Services Funding Extension Measure would not change the current rate.

What could happen if Measure L-24 does not pass?

If the Atascadero Local Roads and Vital Services Funding Extension Measure does not pass, the half-cent per dollar (0.5%) tax, currently collected under sales tax Measure F-14 would no longer be collected. Measure F-14 is set to expire on March 31, 2027. This would mean that Atascadero would no longer receive the approximately $3 million in annual revenue from the sales tax, which accounts for approximately 9% of Atascadero’s annual budget. Atascadero’s annual budget includes expenditures for general City service, such as maintenance and repair of vital infrastructure.